Along with the transition of all employees to a biweekly pay frequency on January 1, 2023, frequency of deductions also changed starting in January. The first biweekly check was a one-week paycheck and only had retirement plan contributions, garnishments, and taxes deducted. Health, dental, and life insurance contributions are deducted over the following 25 pay periods. All other deductions (e.g., retirement plan contributions, flexible spending amounts, garnishments) are deducted over 26 pay periods.

We have two printable charts that help explain how paycheck deductions changed with biweekly pay.

-

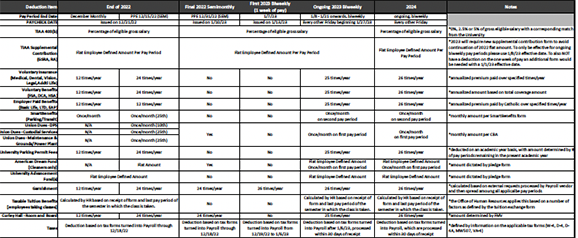

Deduction Chart

This printable chart shows how deductions changed between the 2022 monthly and semimonthly pay frequency, and the new biweekly pay frequency. -

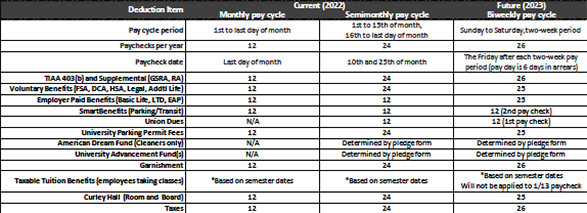

Frequency of Deductions

This printable chart shows the differences in frequency of deductions between the 2022 monthly and semimonthly pay frequency, and the new 2023 biweekly pay frequency.