Plan Enhancements are now available!

The Catholic University of America is excited to introduce new enhancements to the University’s existing 403(b) Defined Contribution Plan. These changes are designed to streamline the enrollment process (i.e. how you sign up for TIAA) and the salary deferral election process (i.e. how you set the amount you want to contribute from each paycheck), as well as increase the options available for saving for retirement.

Participants will make their salary deferral elections directly through their TIAA participant account, instead of through the 403(b) Salary Deferral Form in the Office of Human resources. Also, as of January 1, 2024, participants now have the option of electing to make some or all of their contributions to the plan using Roth style, post-tax salary deferrals. In detail, these enhancements include:

- Online Enrollment and Salary Deferral - Enrollment in TIAA and changes to the amount of your salary you contribute each payroll can be made online at TIAA.org/Catholic. This enhancement has replaced the 403(b) Salary Deferral Google Form. To help simplify the management of your account, you can now go to the same place to make changes to your contributions and investment options.

- Self-directed Auto Increase - Participants are able to elect to automatically increase contributions, including the rate of the increase as well as when to start and stop the automatic increase.

- Roth contributions will be available to be made to the 403(b) plan - Contributions to your retirement account from your pay after taxes, as opposed to pre-tax, are available. While this is a great tool for some to help save for retirement, it is not right for everyone. If you have questions about the Roth contribution option, and determine if this is right for you, please call TIAA at 800-842-2252, Monday through Fridays 8:00 AM-10:00 PM (ET).

- With the Roth option, your after-tax contributions have the potential to accumulate tax free. Withdrawals of earnings prior to age 59 ½ are subject to ordinary income tax and a 10% penalty may apply. Withdrawals after age 59 ½ are tax free if distribution is no earlier than five years after contributions were first made. These potentially significant tax benefits are similar to a Roth IRA. There are other advantages to Roth contributions, including higher contribution limits than a Roth IRA. It is important to speak with a financial advisor for help determining if this is right for you.

Who is impacted:

What does this mean for you?

As part of this transition, all flat amount contributions that had previously been elected to contribute to the supplemental retirement plan have been converted from a dollar amount to a percentage of your pay. This conversion was automatically made based on your election as well as your biweekly payment amount as of the pay period ending 11/25/23.

Moving forward, instead of electing two different salary deferral amounts to contribute to the University's 403(b) plan, one percentage will be elected, and it will be automatically split into the appropriate buckets according to eligibility and plan rules (Matched and Supplemental).

Please note that due to rounding, your future contribution may vary slightly. In addition, please be sure to review your elections with any change in salary that occurs, to determine if you would like to make changes to your elections.

As an example, based on an annual salary of $60,000 ($2,307.69 biweekly), contributions for an eligible employee earning a annualized salary of $60,000/year, who had elected to contribute 5% plus an additional amount of $100 to the GSRA per biweekly paycheck would be updated to a total contribution of 9.33%. The first 5% of that employee’s contribution will be applied to the matching portion of the plan, and the remaining portion will be applied to the supplemental portion of the plan.

|

Prior Election (Configured using the prior Google Form election tool) |

|||

|

Example Biweekly Salary |

CUA Matching Contribution |

Supplemental Contribution |

TOTAL TIAA Biweekly Deferral |

|

$2,307.69 |

5% |

$100 |

$215.38 |

|

New Election (Configured using a single percentage at TIAA) |

||||

|

Example Biweekly Salary |

TIAA Election |

Portion Directed to CUA Matching Contribution |

Portion Directed to Supplemental Contribution |

TOTAL TIAA Biweekly Deferral |

|

$2,307.69 |

9.33% |

5% |

4.33% |

$215.31 |

With this new enhancement, instead of electing two different salary deferral amounts to contribute to the University's 403(b) plan, eligible participants will elect one percentage, and it will be automatically split into the appropriate buckets according to eligibility and plan rules (Matched and Supplemental).

Quiet Period:

The previous 403(b) Salary Deferral Google form used to set or adjust your contributions was accepted through Monday, 11/27. Following this date, there was a quiet period where no changes were accepted until the system was live. Now, all election changes must be made by logging into your TIAA account at TIAA.org/Catholic.

Take Action:

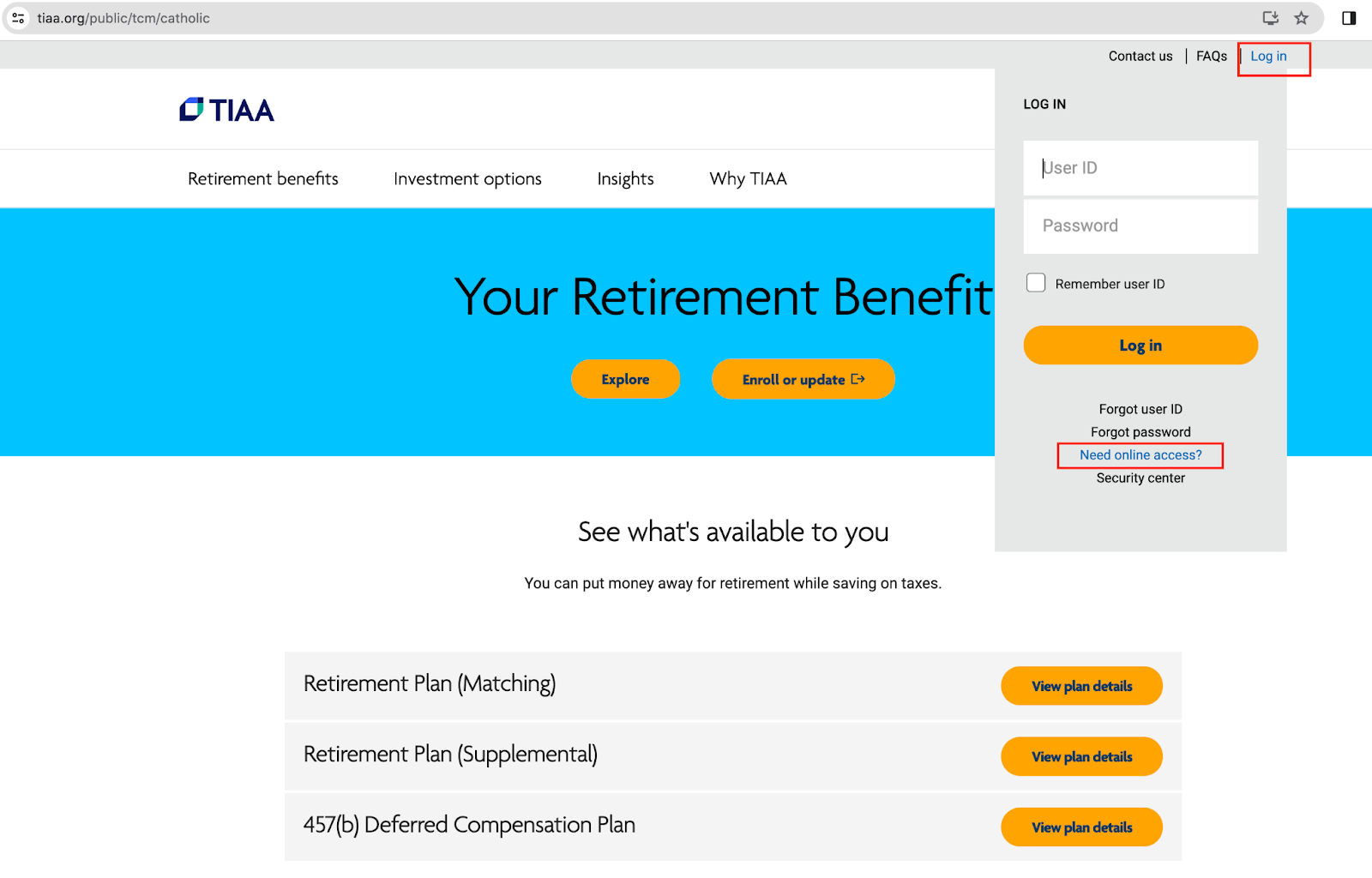

- Create your TIAA Account Today: Don’t wait! If you have not already done so, we encourage you to set up your online account with TIAA today! We also urge you to review your current elections to see if you’d like to make any changes to your elections. Navigate to https://TIAA.org/Catholic to log in, or create an online account if you have not already done so:

Don’t have an online account? Getting set up is easy:

Visit TIAA.org/Catholic > Go to Log in in the upper-right corner and then Need online access?

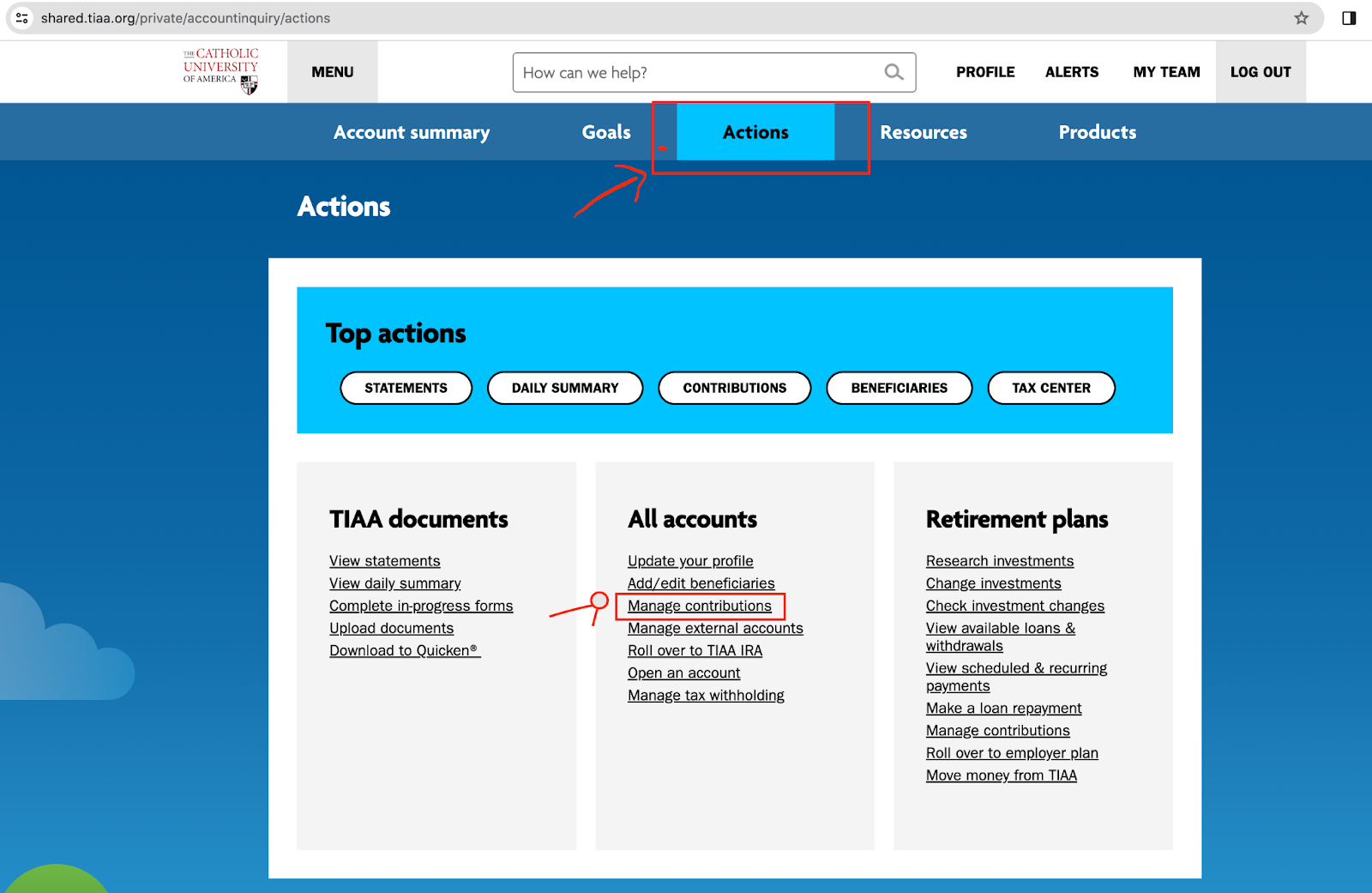

- Review your current elections: log onto your online TIAA account to make sure you are happy with your elections. If you would like to make any changes, you will now do so by logging into your TIAA account at TIAA.org/Catholic, and select Manage Contributions under the Actions menu. Please note this service uses your TIAA account and is unrelated to your CUA Network account credentials. Instructions are provided below to create that account if you have not already done so:

- Schedule an Appointment with a TIAA Financial Consultant by calling 800-732-8353 weekdays from 8:00 AM- 8:00 PM for help considering how to save more for retirement.

If you are considering updating your contributions to Roth, after tax elections, we suggest that you first speak with a financial advisor to help understand the change. TIAA representatives are on hand help you decide if the Roth Contribution option is the right tool for you. To discuss the Roth contribution option, and determine if this is right for you, please call TIAA at 800-842-2252, Monday through Fridays 8:00 AM-10:00 PM (ET). - Visit TIAA.org/Catholic anytime to learn more about your plan and its available options.

What if I do nothing:

Please note that due to rounding, your future contribution may vary slightly. We encourage all participants to review their elections when the new system is live to determine if any changes are desired.

Questions? Contact HR-Partners@cua.edu should you have any questions.