In response to financial strain associated with the Coronavirus pandemic, Catholic University temporarily suspended employer contributions and match funding to the Defined Contribution Retirement Plan 403(b). As announced in the letter from President John Garvey last year, contributions were suspended from September 1, 2020 through August 31, 2021 as part of a suite of austerity measures to support the University. During that period the Defined Contribution Retirement Plan remained active and employee contributions continued without disruption. We are happy to announce that both the employer contribution and match levels will be restored as of September 1, 2021.

Retirement Planning Resources

Virtual One-on-one Counseling Sessions

A team of financial counselors is available to assist CatholicU employees through Virtual one-on-one counseling sessions.

To Schedule an appointment.

- Click this link to schedule a date and time: TIAA online scheduling tool

- Click the Select State button

- Choose "District of Columbia" from the state of residence dropdown list

- Use the calendar to select a date and time that is convenient for you

- Select “Consultant” if you would like to meet with a specific financial consultant

Live and on-demand webinars

CatholicU Employees may attend live webinars on a variety of topics monthly. TIAA also offers webinars that are available for viewing at the employee’s convenience, on demand. Registration for webinars is available through this streamlined link.

Review Current Settings

Employer matching contribution settings will automatically resume on September 1, 2021, according to your current elections. Those settings are now available for your review within Employee Self Service in Cardinal Faculty and Staff. Current employees can navigate to the “403b Contribution” tile by logging into Cardinal Faculty and Staff and selecting “Employee Self Service.”

Updating Current Elections

Now would be the perfect time to review your settings and, if needed, to make changes by filling out the Salary Deferral Form. Changes will need to be made by September 15th to ensure they are in place for the September payrolls.

For a review of the University’s Defined Contribution Retirement Plan see: https://humanresources.catholic.edu/benefits/retirement.html

Restoration of 403(b) Contributions FAQ

When is the restoration of the employer contribution to the 403(b) retirement plan happening?

The employer contribution will be restored as of September 1, 2021.

How can I review my current 403(b) contribution rate and YTD contributions?

Employees are able to view their current elections through Cardinal Faculty and Staff "Employee Self Service". Navigate to the "403 (b) Contribution" tile by logging into Cardinal Faculty and Staff and selecting "Employee Self Service".

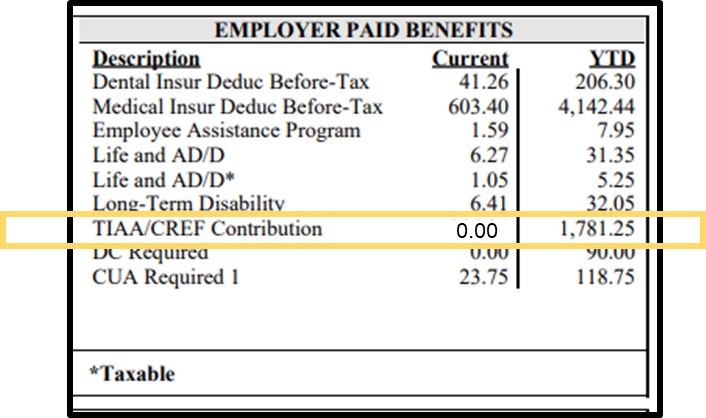

How will this impact my paycheck?

Beginning September 1, 2021, employees will notice the employer contribution automatically restored to their paycheck. To view your earnings statement, please log into Cardinal Faculty & Staff and click on the “Pay” tile. The restored contribution will be available for viewing on the pay stub after pay has been issued for September 2021. Below is a sample earnings statement.

Are there any limits to the amount I can contribute to the plan?

Yes, your employee contributions are limited by IRS regulations. In 2021, the IRS will allow participants under the age of 50 to contribute up to $19,500 for the year. Participants aged 50 and older are permitted to contribute an additional $6,500. Please note that these limits apply to the combined amount you contribute to both the Supplemental Retirement Plan and the Defined Contribution Retirement Plan. The maximums apply only to employee contributions, so the contributions Catholic University made to the 403(b) plan do not count for purposes of calculating this limitation.

|

2021 |

|

|

403(b) plan effective deferral |

$19,500 |

| Catch-up contributions for participants aged 50 and older | $6,500 |

Please note that this limit does apply to all the tax-deferred contributions you may have made to other 401(k) or 403(b) plans during the calendar year. This rule commonly affects participants who change employers during the year, but can also affect any employee who contributes to more than one employer’s plan or plans in the same calendar year. If you contribute to more than one employer’s retirement plan or plans simultaneously, you will need to monitor your contributions so you do not exceed the limit.

How do I calculate my employee contribution to reach the IRS maximum for this year?

Please call TIAA's National Contact Center at 1-800-842-2252 to request assistance with calculating your employee contribution in order to reach the maximum for this year. The HR Partners team can also assist with calculations as needed.

What happens to the money that is in my Defined Contribution Retirement 403(b) plan account?

The money in your Defined Contribution Retirement Plan account remains there until you retire or leave Catholic University.

How can I make changes, or begin contributing to the 403(b) plan?

Please complete the 403(b) Salary Deferral Form. This form will automatically be submitted to the HR Partners team for review. For all forms received by the 15th of the month, the change will be effective is the first of the month in which the form is received, unless a later date is specified. For example, for semi monthly employees, if the form is submitted on August 15th, the change will take effect on August 1st and will be reflected starting in the employees August 1 - August 15 paycheck (pay date of August 25). For monthly employees, the change will take effect on August 1st and will be reflected starting in the employee's August 1 - August 31 paycheck (pay date of August 31).

What are the contribution rates for the Defined 403(b) plan?

Employees are able to contribute 0%, 2.5% or 5% of their salary to the Defined 403(b) plan. However, if you prefer to contribute an amount other than 2.5%, or 5%, you can elect a dollar amount in the Supplemental Contribution Retirement Plan. You may also supplement your retirement savings, if you wish, by participating in the Supplemental Contribution Retirement Plan.

Do I need to take any actions?

The restoration of Catholic University’s contributions to the 403(b) plan will take place automatically and you do not need to do anything. However, you may wish to review your retirement plan account and potentially adjust your own employee contribution. The IRS annual contribution limit on employee contributions to the 403(b) plans is $19,500 per year (for 2021). If you are age 50 or older, you may also be eligible to make “catch-up” contributions, up to an additional $6,500 for calendar year 2021.

Is there information regarding concerns about the recent market volatility?

Please check out guidance for investors from our retirement plan vendor, TIAA: https://www.tiaa.org/public/.

Who can I talk to if I need help with retirement planning?

Virtual one-on-one counseling sessions are being offered by our retirement provider, TIAA. To schedule an appointment with our TIAA representative, Jonathan Imber, please call the TIAA Scheduling department at 1-800-732-8353 or use the TIAA online scheduling tool (directions below). Please note: The sessions are free, however, an appointment is required.

To Schedule an appointment.

- Click this link to schedule a date and time: TIAA online scheduling tool

- Click the Select State button

- Choose "District of Columbia" from the state of residence dropdown list

- Use the calendar to select a date and time that is convenient for you

- Select “Consultant” if you would like to meet with a specific financial consultant

When the temporary suspension is lifted, will matching contributions be applied for the missed time period?

No. Once matching contributions resume, it will be applied going forward based on the effective date of the change.