In response to the Coronavirus pandemic, Catholic University will temporarily suspend employer contributions to the Defined Contribution Retirement Plan 403(b). As announced in the letter from President John Garvey on June 23rd, contributions will initially be suspended from September 1, 2020 through August 31, 2021 and are part of a suite of measures to support the University. Although the University is suspending employer contributi

Suspension of University Contributions to Defined Contribution Retirement 403(b) Plan FAQ

Why is the University suspending the employer contribution to the 403(b) retirement plan?

With the current pandemic, the University faces both reduced revenue and increased costs this fiscal year. Among many steps the University will take to mitigate these financial impacts, suspending employer contributions will reduce University expenses while avoiding a direct impact to one's take-home pay.

When is this happening?

The University employer contribution to 403(b) plans will stop after August 31, 2020. When you look at your third quarter statement from TIAA, you will see that the University contribution is no longer included. Your employee contributions to your retirement plan(s) will not be impacted unless you choose to adjust them. To check out your TIAA account information, please log into your account at https://www.tiaa.org/public/tcm/catholic.

How can I review my current 403(b) contribution rate and YTD contributions?

Please contact our HR Partners team to assist with obtaining your 403(b) contribution rate and year to date (YTD) contributions.

How will this impact my paycheck?

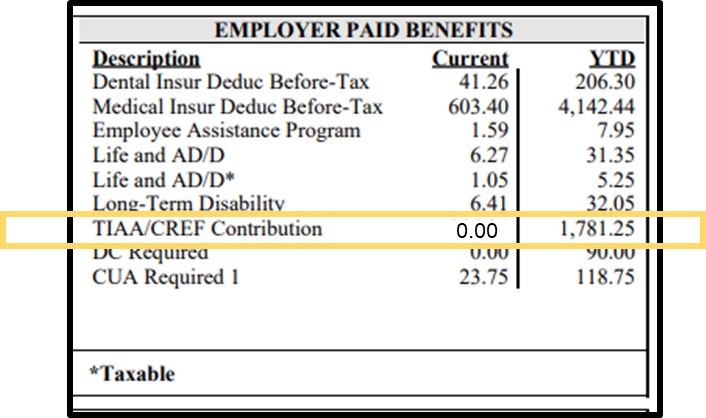

In the “employer paid benefits” section of your earnings statement, under the “current” column, the University matching contribution will show "0.00". This will first appear on September 25th for non-exempt employees (bi-monthly) or on the September 30th statement for exempt employees (monthly). The year to date (YTD) matching contribution amount will still be displayed and will reflect employer contributions from January 1, 2020 – August 31, 2020. To view your earnings statement, please log into Cardinal Faculty & Staff and click on the “Pay” tile. Below is a sample earnings statement.

Are there any limits to the amount I can contribute to the plan?

Yes, your employee contributions are limited by IRS regulations. In 2020, the IRS will allow participants under the age of 50 to contribute up to $19,500 for the year. Participants aged 50 and older are permitted to contribute an additional $6,500. Please note that these limits apply to the combined amount you contribute to both the Supplemental Retirement Plan and the Defined Contribution Retirement Plan. The maximums apply only to employee contributions, so the contributions Catholic University made to the 403(b) plan do not count for purposes of calculating this limitation.

|

2020 |

|

|

403(b) plan effective deferral |

$19,500 |

| Catch-up contributions for participants aged 50 and older | $6,500 |

Please note that this limit does apply to all the tax-deferred contributions you may have made to other 401(k) or 403(b) plans during the calendar year. This rule commonly affects participants who change employers during the year, but can also affect any employee who contributes to more than one employer’s plan or plans in the same calendar year. If you contribute to more than one employer’s retirement plan or plans simultaneously, you will need to monitor your contributions so you do not exceed the limit.

How do I calculate my employee contribution to reach the IRS maximum for this year?

Please call TIAA's National Contact Center at 1-800-842-2252 to request assistance with calculating your employee contribution in order to reach the maximum for this year. The HR Partners team can also assist with calculations as needed.

What happens to the money that is in my Defined Contribution Retirement 403(b) plan account?

The money in your Defined Contribution Retirement Plan account remains there until you retire or leave Catholic University.

Will my own employee contribution toward my Defined Contribution Retirement 403(b) plan account continue?

Yes. However, you can choose to adjust this contribution if you wish.

How can I make changes, or begin contributing to the 403(b) plan?

Please complete the 403(b) Salary Reduction Form. This form will automatically be submitted to the HR Partners team for review. For all forms received by the 15th of the month, the change will be effective is the first of the month in which the form is received, unless a later date is specified. For example, for semi monthly employees, if the form is submitted on August 15th, the change will take effect on August 1st and will be reflected starting in the employees August 1 - August 15 paycheck (pay date of August 25). For monthly employees, the change will take effect on August 1st and will be reflected starting in the employee's August 1 - August 31 paycheck (pay date of August 31).

What are the contribution rates for the Defined 403(b) plan?

Employees are able to contribute 0%, 2.5% or 5% of their salary to the Defined 403(b) plan. However, if you prefer to contribute an amount other than 2.5%, or 5%, you can elect a dollar amount in the Supplemental Contribution Retirement Plan. You may also supplement your retirement savings, if you wish, by participating in the Supplemental Contribution Retirement Plan.

Do I need to take any actions?

The suspension of Catholic University’s contributions to the 403(b) plan will take place automatically and you do not need to do anything. However, you may wish to review your retirement plan account and potentially adjust your own employee contribution. The IRS annual contribution limit on employee contributions to the 403(b) plans is $19,500 per year (for 2020). If you are age 50 or older, you may also be eligible to make “catch-up” contributions, up to an additional $6,500 for calendar year 2020.

Is there information regarding concerns about the recent market volatility?

Please check out guidance for investors from our retirement plan vendor, TIAA: https://www.tiaa.org/public/.

Who can I talk to if I need help with retirement planning?

Virtual one-on-one counseling sessions are being offered by our retirement provider, TIAA. To schedule an appointment with our TIAA representative, Jonathan Imber, please call the TIAA Scheduling department at 1-800-732-8353 or use the TIAA online scheduling tool (directions below). Please note: The sessions are free, however, an appointment is required.

- Open the scheduling tool by clicking on the following link: TIAA online scheduling tool

- Click the Select button

- Choose "District of Columbia" from the State dropdown list and then click Select

- Choose "THE CATHOLIC UNIVERSITY OF AMER." from the Employer dropdown list and click Select

- Use the calendar and follow instructions on the screen to schedule an appointment

Are there other changes to the retirement plans that result from the CARES Act?

Below are important changes for the 403(b) plans that are permitted under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) and intended to aid our employees and their families who may be suffering financial hardship during these uncertain times.

If you qualify (more information on eligibility is below), you may:

- Withdraw your employee contributions or any rollover funds from the Catholic University 403(b) plan without penalty (which is usually 10% if you are under age 59½). The 10% waiver can cover withdrawals up to $100,000 made between January 1 and December 31, 2020. You can choose to treat the withdrawal as a distribution (which means that your retirement plan account will not be repaid and you can have taxes spread over three years) or choose to repay the amount back to your account (without interest and repayments can be made over three years and will not be counted towards the annual contribution limits).

- Have an increased cap on the amount you can borrow from your 403(b) plan (increased from $50,000 to $100,000, or 100% of your employee contributions and any rollover funds). Please note that under federal law, this increased loan limit is only available from March 27, 2020 through September 22, 2020.

- If you already have an outstanding loan, all loan payments due between March 27, 2020 through December 31, 2020 can be deferred for up to one year, but interest will continue to accrue. To qualify and be eligible for the above, you must meet one of these criteria and self-certify to your retirement plan record keeper:

- You, your spouse, or dependent was diagnosed with coronavirus;

- You have experienced adverse financial consequences as a result of being quarantined, furloughed, or laid off, or your work hours have been reduced;

- You are unable to work because of a lack of child care;

- You have had to close or reduce the hours of a business as a result of the virus; or

- You have been financially impacted by other factors determined by the US Secretary of Treasury.

When the temporary suspension is lifted, will matching contributions be applied for the missed time period?

No. At this time, the University is not planning to restore contributions missed during the temporary suspension. Once matching contributions resume, it will be applied going forward based on the effective date of the change.